Europe’s Defense Technology Crossroads: Translating Ambition into Advantage

Executive Summary

As Europe contends with the repercussions of Russia’s war on Ukraine and reawakening security competition, a historic surge in defense investment is reshaping the continent’s industrial and geopolitical landscape. Yet, even as new funding reaches record levels, longstanding bottlenecks-from sluggish procurement to fragmented industrial strategies-hinder the translation of these resources into battlefield-ready capabilities. Drawing on recent war lessons and the state of innovation funding, we explore these dynamics and recommend ways to close the gap between ambition and operational effect, with the intention of moving past the current climate of persistent insecurity.

The Stakes for Europe’s Security

The war in Ukraine has forced a fundamental reappraisal of European defense. High-profile pledges from the European Union, NATO members, and national governments have unleashed a wave of funding aimed at rearming, modernizing, and strengthening alliance interoperability. Yet, translating this political and fiscal momentum into credible military power remains profoundly challenging. The ability of Europe’s defense ecosystem-spanning government, private industry, and R&D-to deliver competence, speed, and innovation will not only determine the fate of Ukraine but also define Europe’s global technological relevance in the decade to come.

Is There Still a Funding Problem in European Defense Tech?

On the surface, Europe is experiencing a historic abundance of defense funding, reflected in blockbuster announcements from the European Defence Fund (EDF) and proliferating national initiatives. However, debate continues about whether these headline figures yield the usable, well-distributed capital needed for true transformation.

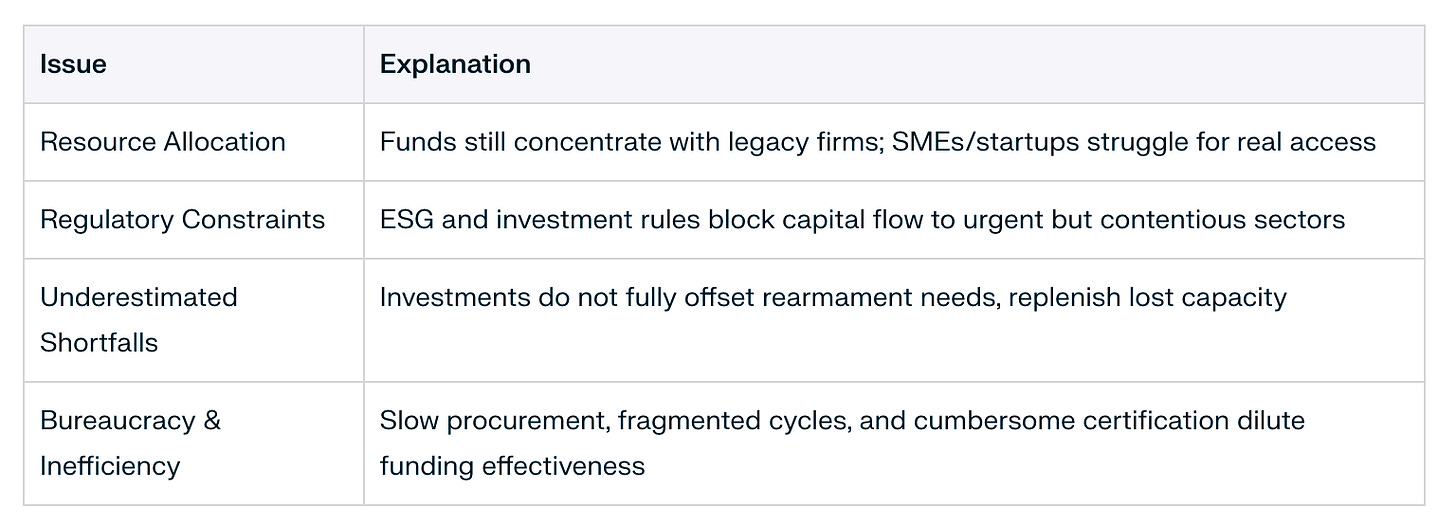

While nominal funding for defense technology is surging, several persistent bottlenecks, including resource allocation, regulatory barriers, and bureaucratic inertia, continue to limit the translation of this financial support into battlefield-ready solutions.

The Reality of Funding: Headline vs. Usable Resources

Large Sums, But Gaps Remain: Despite over €150 billion in new defense funds and robust EDF investments, industry leaders note these increases are inadequate to close Europe’s accumulated “defense deficit” and restore a production base hollowed out by decades of underinvestment. The European Defence Agency continues to track a €600 billion shortfall in capability

Structural Imbalances: Funding remains disproportionately concentrated with major legacy defense contractors, as regulatory, market, and bureaucratic barriers prevent agile SMEs and startups from accessing capital critical to rapid innovation.

ESG and Regulatory Barriers: Strict “sustainable investment” policies impede financing for high-priority-but politically sensitive-sectors such as lethal munitions, drones, and battlefield AI, resulting in a paradox of visible funding but persistent technological gaps.

Table 1: Is There Still a Funding Problem in European Defense Tech?

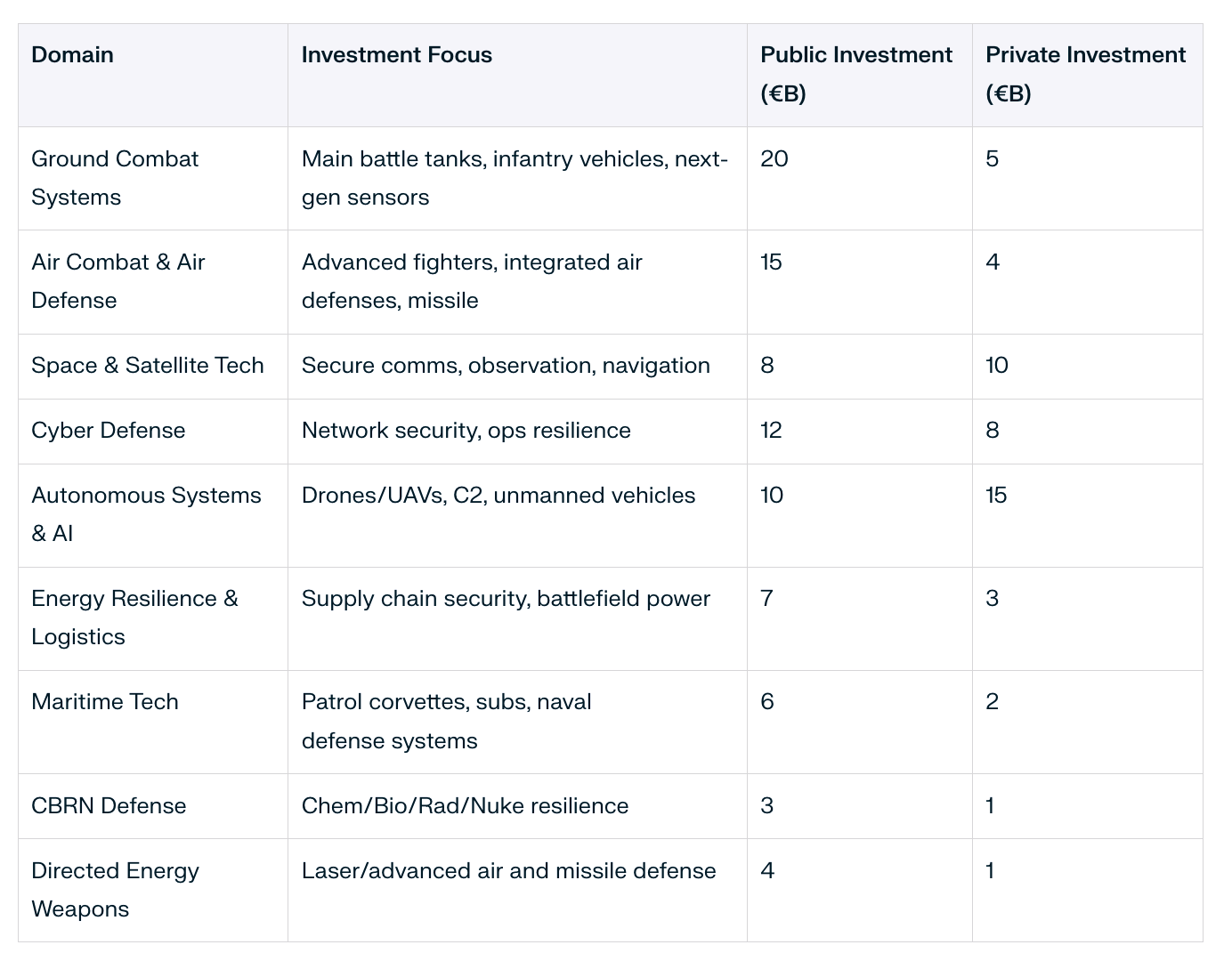

Where the Money Goes: Top Priority Funding Domains

European defense funding is now highly targeted toward critical technological and operational domains, reflecting both longstanding capability needs and lessons drawn from the Ukraine conflict. The following table presents the core focus of investment along with the estimated public (EU and national government) and private (industry, venture capital, and corporate) funding figures for 2021–2027.

Table 2: Top Priority Funding Domains in European Defense

Battlefield-Driven Innovation: Lessons from Ukraine

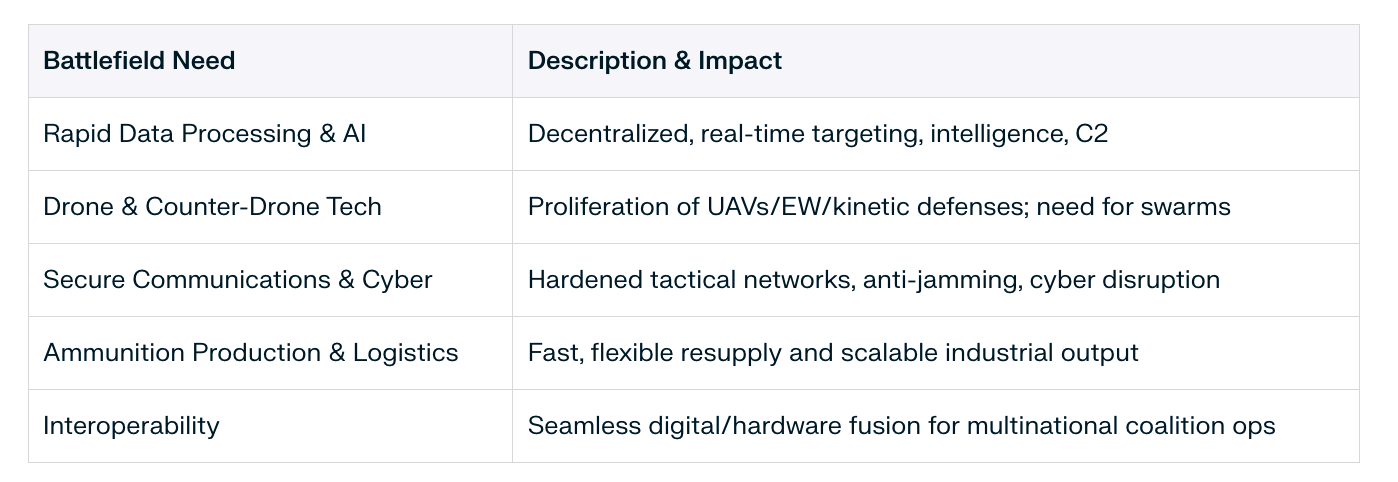

The war in Ukraine has clarified which technologies are indispensable for 21st-century defense. Rapid adaptation, creative technology integration, and logistics surges have redefined what is possible for modern European defense.

Table 3: Battlefield-Driven Innovation: Lessons from Ukraine

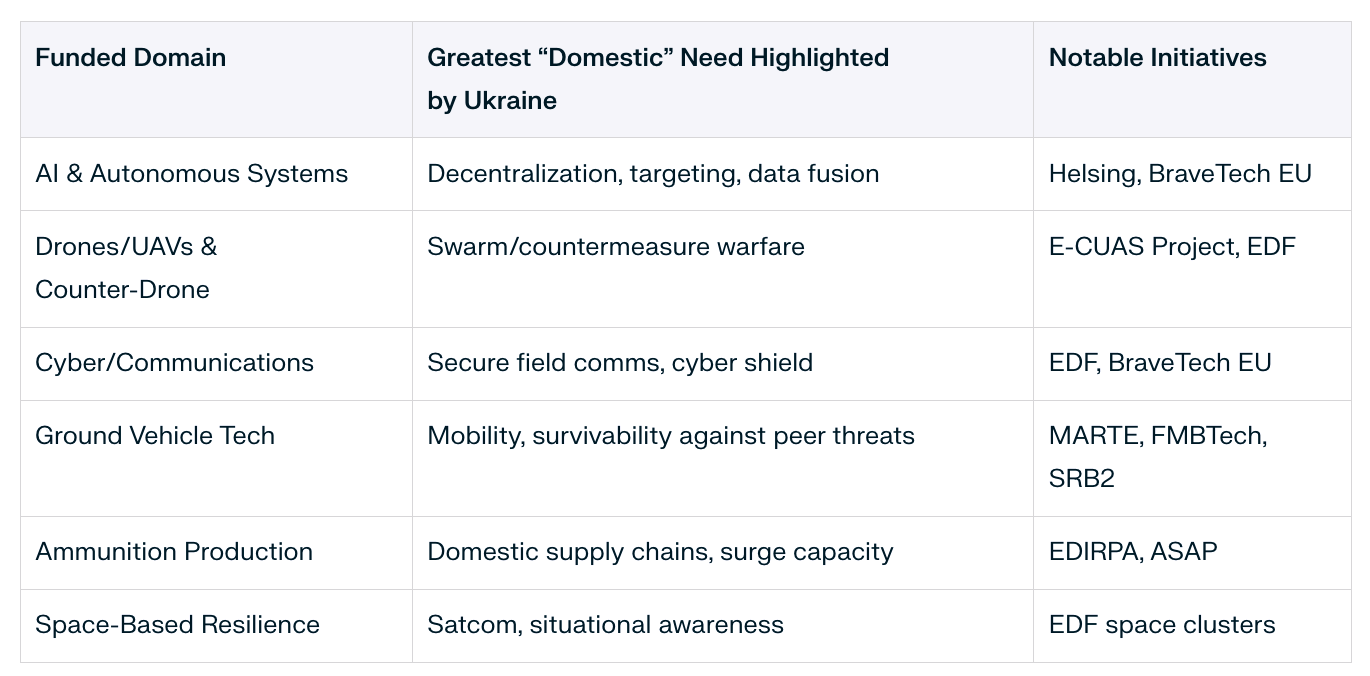

Focus & Needs in European Defense Tech: Aligning Funding with Urgency

Major funding programs increasingly align technical modernization with battlefield-proven needs. This focus seeks not only to acquire new systems, but to foster homegrown innovation in areas critical to Europe’s strategic autonomy.

Table 4: Defense Tech Focus & Needs

Bottlenecks Facing European Defense Tech: A Persistent Drag on Readiness

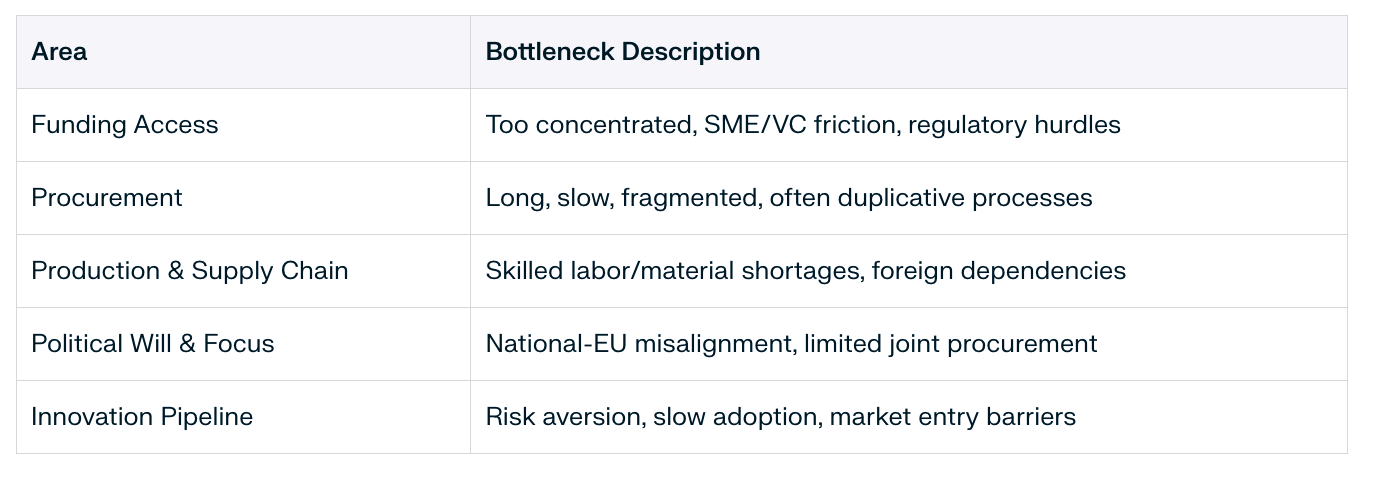

Despite new funding, systemic problems persist that blunt Europe’s ability to field modern, scalable, and interoperable capabilities.

Table 5: Bottlenecks Facing European Defense Tech

Interoperability and Production: Enduring Vulnerabilities

System interoperability is severely hampered by siloed national standards, legacy equipment, and limited real-time data-sharing protocols, impeding seamless coalition operations. Slow production, compounded by skills shortages, supply chain fragility, and cumbersome certification, limits Europe’s ability to scale ammunition or new systems at the pace demanded by modern warfare.

Ongoing Solutions and Policy Innovations

Europe’s leaders are launching coordinated initiatives to address these weaknesses. Joint procurement and digital interoperability programs such as EDIRPA, EDIDP, and NATO’s Defence Innovation Accelerator aim to harmonize standards and enable resource pooling. Capacity investments now target new production lines, training, and simplified certifications. SME and start-up support schemes (BraveTech EU, EUDIS) lower funding barriers for non-traditional actors and speed battlefield-proven innovation adoption.

Case Studies: Europe’s Emerging Successes

Ukrainian Drone Adaptation: Loitering munitions, funded via hybrid European and local partnerships, are shaping both battlefield dynamics and European procurement reform.

AI Integration (Helsing): Start-ups are pioneering real-time data synthesis and battlefield AI for NATO mission readiness.

Joint Ammo Initiatives: Multi-country contracts are restoring industrial-scale ammunition production, enhancing autonomy relative to the U.S.

Investment & Market Trends: The New Defense Landscape

Private venture activity in European defense tech, particularly in AI, cyber, and space, has surged. Both commercial and security imperatives are driving this trend. However, regulatory risk and slow acquisition cycles remain concerns for many investors, making policy adaptation crucial for sustaining long-term growth.

Geostrategic and Workforce Considerations

Europe’s urgency is amplified by deteriorating relations with Russia, pressure to reduce U.S. dependency, and increased competition from China. Defense sector resilience increasingly depends not just on capital and contracts, but also on technical training, cross-sector mobility, and the integration of academia, startups, and military R&D ecosystems.

Policy Recommendations

To convert investment into operational capacity:

Streamline Regulation and Procurement: Harmonize standards and institute fast-track approval for SMEs and dual-use innovators.

Dedicate SME/Start-up Funding: Ring-fence new entrant funding for dual-use and military tech.

Pilot Joint Multinational Procurement: Focus first on munitions, drones, and command networks.

Revise ESG and Investment Rules: Make urgent exceptions for high-battlefield-impact technologies.

Invest in Workforce and Tech Talent: Expand apprenticeships, technical education, and cross-sector mobility.

Scale Up Public-Private Partnerships: Institutionalize faster adoption and scaling of frontline-validated solutions.

Conclusion: Beyond Spending-Synchronization, Speed, and Strategic Unity

Europe’s new investments matter, but only if quickly synchronized across political, industrial, and innovation domains. The lessons of Ukraine are unequivocal: success hinges on an ecosystem that prizes speed, agility, and joint action. By linking funding discipline to real operational needs, breaking out of legacy silos, and prioritizing skills and partnerships, Europe can set a global standard for rapid, resilient, and technologically sovereign defense.

Article Sources:

European Defence Agency, “Defence Data 2022.”

European Commission, “A New Era for European Defence,” 2023.

EDF, Annual Implementation Report, 2023.

Korte, G., “EU Boosts Arms Fund, but Gaps Persist,” Defense News, 2024.

Wall, R., “Europe’s ‘Defence Deficit’ in Numbers,” Financial Times, 2024.

ASD Europe, “The SME Challenge in European Defence,” 2023.

European Investment Bank, “ESG and Defence: Current Impacts,” 2023.

European Court of Auditors, “Defence Procurement in the EU,” 2024.

NATO Innovation Hub, “Frontline Feedback: Ukraine Tech Lessons,” 2025.

BraveTech EU, Project Summary, 2024.

German Industry Federation (BDI), “Europe’s Defence Bottlenecks,” 2024.

European Commission, “Defence Innovation Schemes,” 2024.

PitchBook, “European Defense Tech VC Trends,” 2025.

Defense Update Ukraine, “Ukrainian Drone Ecosystem,” 2024.

Sifted, “VC Moves Into European Defense,” March 2025.

ECFR, “Geostrategic Shifts and European Defence,” 2024.

EU Parliament, “Defence Industrial Policy and Workforce,” 2024.

EUDIS, Annual Impact Review, 2024.

NATO DIANA, Vision & Activities, 2024.

ASD/IRIS, “Industrial Bottlenecks in the Munitions Supply Chain,” 2024.

European Commission, “Joint Procurement and Interoperability Programs,” 2023.

Bruegel, “Making European Defence Innovation work,” 2023.