US-China Deal Will Not Loosen China’s Grip on Rare Earths

Last week, U.S. President Donald Trump discussed a draft “framework” with Beijing aimed at resolving ongoing trade disputes. President Trump mentioned China's export controls on seven rare earth elements, which are important due to their use in high-tech products, such as magnets for cars. “Our deal with China is done, subject to final approval with [Chinese] President Xi and me,” Trump wrote in a post on Truth Social. “Full magnets, and any necessary rare earths, will be supplied by China.” In return, the U.S. has agreed to drop plans to revoke Chinese student visas.

However, tensions remain. The Defense Logistics Agency (DLA) maintains strategic stockpiles of critical minerals to be used in emergencies. These stockpiles include 48 minerals and alloys stored across various U.S. locations. Traditionally, these stockpiles serve as a "break glass" capability. However, recent supply chain issues and trade disputes with China have caused shortages. In April, exports of rare earth minerals from China dropped by about 50% and in May, China halved the amount it exports again - rare earth exports to the US were down by 92% compared to May 2024. Consequently, the DLA has been debating providing these materials to defense and commercial manufacturers due to shortfalls.

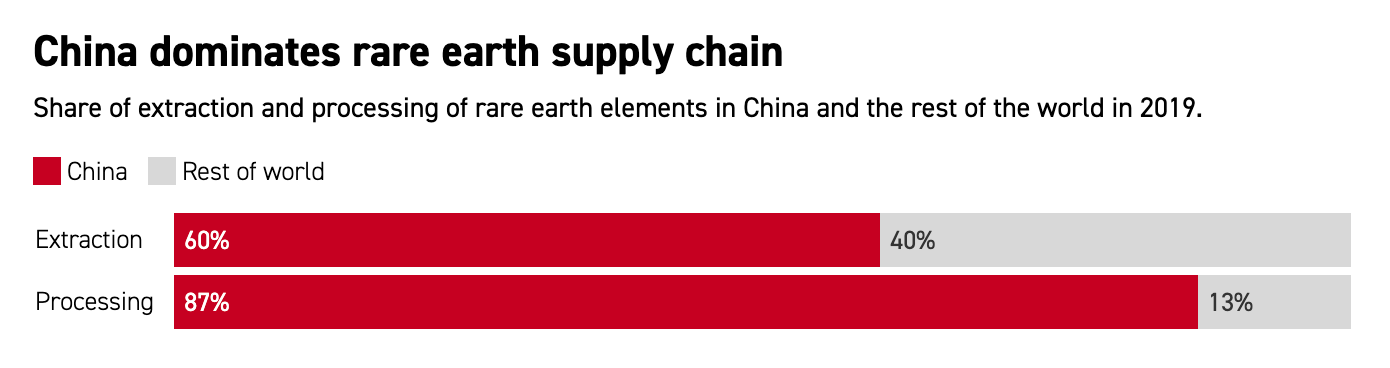

China controls around 90% of the rare earth products on the market. The country’s dominance in strategic mineral supply chains, particularly rare earths crucial for military goods, has created dependencies. The United States faces further challenges in securing supplies because China also excels at refining these minerals to high purity levels required for defense applications. The U.S. relies entirely on China for copper imports, for example, due to a lack of domestic refining capabilities. This dependency extends to other commodities, complicating production for U.S. manufacturers. Ongoing trade negotiations have exacerbated this issue, fueling the debate around the potential issuance of stockpiled minerals to mitigate risks.

While the U.S. military's share of mineral consumption is small, rare earth refining remains dominated by China despite abundant domestic deposits. Efforts to diversify supply chains include investments in domestic mining and processing of materials. Companies like MP Materials, for example, are working to bring rare earth processing back to the U.S. Whole-of-government solutions, including recycling through the Strategic Material Recovery and Reuse Program, are also being applied - germanium from used rifle scopes and titanium from outdated items are being repurposed for advanced manufacturing, such as 3D printing.

Military aircraft require high-performance materials, such as heat-resistant super-alloys, for engines and niche elements for guidance systems. China's stricter export licensing for metals such as tungsten, indium, antimony, beryllium, and tellurium is impacting availability and prices - causing the U.S. and other countries to seek alternative supplies. As China controls over 80% of tungsten, the introduction of export restrictions caused prices to surge. Antimony's primary use in defense applications also led to price surges following Chinese export controls. Rhenium and hafnium, which essential for aerospace and nuclear-powered submarines, are produced in small quantities and also saw significant increases in price due to high demand.

Ongoing geopolitical tensions continue to drive demand for materials used by defense industries. Conflicts like those between Russia and Ukraine caused global military spending to rise to $2.4 trillion in 2023, up nearly 7% from 2022, with the US, China, and Russia the biggest spenders. Increasing defense budgets globally highlight the need for secure and diverse supply lines. Dependable supply chains are becoming increasingly vital amid rising political and trade tensions.

Related:

Rare Earth Minerals Supply Virtually Cut Off by China

China’s Got the World in a Rare Earth Choke Hold

How China Wields Rare Earths As a Strategic Weapon

Trump Touts Trade ‘Deal’ with China

Ford CEO says rare earths shortage forced it to shut factory